This post will explain Customer retention metrics. What’s the key active ingredient for growing your B2B service without requiring to obtain new customers? Customer retention. After all, the more earnings you produce from your existing customers, the less pressure you place on your customer acquisition efforts. Simply put, you’ll be less pressured to obtain new clients if your existing ones continue to purchase.

Top 10 Best Customer Retention Metrics & How to Use Them

In this article, you can know about Customer retention metrics here are the details below;

The challenge? Without customer retention information, you won’t understand if you’re doing a great task keeping clients, you won’t know if you’re losing too many high-value accounts, and so on. If you don’t have this info and you do not know how to get it, you won’t be able to make business decisions you need to for your customer success strategy.

What are customer retention metrics?

Customer retention metrics are aspects, or variables, utilized to determine the probability of keeping and attracting customers to your organization. These systems of measurement are utilized in various formulas produced to figure out the efficiency of business operations in a given period.

Why are customer retention metrics important?

The more consumers you maintain, the more recurring profits you can generate or the more upsells and cross-sells you can protect later on. Plus, a customer who visits with you is happy with your services and products, increasing the probability that they’ll refer more customers to you.

Marketing, sales, customer service, & even product management teams can all gain from customer retention data. This details helps each group tweak their contribution to the customer journey and develop more wonderful adventures for your user base.

While there are bunch of metrics for your business can keep track of, we’ve curated a list of the multiple significant ones below. Let’s take a look.

Calculating this data can be lengthy. And, if you resemble me, it can be discouraging trying to crunch numbers just to discover the outcomes do not add up. That’s why we have actually developed the calculator below to assist your team gain accurate insights.

HubSpot’s Client service Metrics Calculator was constructed to save you time and calculate your organization’s customer retention metrics with ease. All you need to do is enter the numbers for your business and quickly see your customer retention rate, income churn, customer life time value, and more. Track these metrics with time to see how your retention is improving.

Now let’s come down to it.

1. Customer Retention Rate

Measures: the rate a business has kept customers over a time period.

The most directly forward customer retention recipe is, well, the retention rate. You require to understand how much of your customer swimming pool is becoming loyal per duration to see if your present technique is drawing them in at a sufficient rate.

How to Compute Customer Retention

It requires time to see how effective your retention technique is working. To do this, build up the number of consumers you had at the beginning of a period, then all the customers that onboarded in between, then the number you had at completion of the duration.

Subtract the digit at the end from the freshly acquired, and divide that option by the number of clients you had in the beginning.

If you have a fairly small customer list, semi-annual or yearly tracking will be adequate.

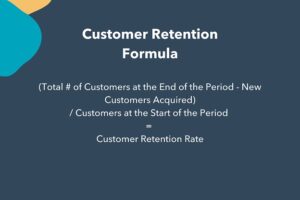

Retention Rate Formula

Customer Retention Rate = (Clients at the End of the Period) – (New Clients Obtained)/ Clients at the Start of the Duration

Customer Churn

Measures: the rate consumers stop working with you.

Maybe the most simple of customer retention metrics, your company’s customer churn rate describes the rate at which customers stop doing business with you. Whether the customer has actually ended or pulled out of restoring a subscription, a churned customer is a customer that your service didn’t keep.

With that stated, attrition in your customer base is natural to a specific degree. For example, a customer might have gone through a significant modification. Perhaps their organization was gotten or they declared bankruptcy. Perhaps they no longer need your product or service.

However, if your yearly churn rate is greater than 5-7%, it’s time to examine the joy of your consumers– and discover why there may be an issue. A high churn rate is usually a sign of your product and services failing to fulfill your clients’ expectations or goals.

How to Calculate Customer Churn

How frequently you determine and analyze your business’s churn rate will depend upon the volume of business your company performs. For instance, if you have hundreds or countless customers, it may be prudent for your marketing, sales, or customer success team to track churn monthly.

If you have a relatively little customer list, a semi-annual or yearly tracking will be adequate. Keep in mind that brand-new consumers you onboard in whatever period you select must not be factored into the churn rate.

Churn Rate Formula

Yearly Churn Rate = (Variety Of Consumers at Start of Year – Variety Of Consumers at End of Year)/ Variety Of Customers at Start of Year

Example of Customer Churn

To determine churn rate, we can utilize the example metrics below.

Let’s state our company began September with 10K customers. At the end of the month, we discovered that 500 left our company. This would mean our churn rate is 5 % ( 10,000 consumers – 9,500 consumers)/ 10,000 customer = 5%).

Now, let’s state we acquired 275 consumers throughout September & lost 500 more during October. Our churn rate for October would then be 5.11% (( 9,775 clients – 9,225 clients)/ 9,755 clients = 5.11%).

Retention rate is in some cases puzzled with churn rate. However, these 2 metrics are clearly different. Also check Alibaba swot analysis

Churn Rate vs. Retention Rate

Retention rate is the ratio of consumers that go back to do business at your company. This varies from churn rate because churn rate describes the variety of clients you’ve lost over a time. A company with a high churn rate would, by default, have a lower retention rate.

2. Revenue Churn Rate

Steps: the rate income is lost from existing consumers.

Your profits churn rate is the portion of profits you have actually lost from existing consumers in an offered period. For example, revenue churn can result from an order cancellation, a strategy downgrade, or an end to a service relationship. Particularly for SaaS (Software Application as a Service) business, revenue churn rate is a vital indication of customer complete satisfaction.

While total profits churn rate offers a bird’s eye view of customer health, it needs to be tracked on a specific basis. Your customer success group’s main objective is to proactively guarantee clients aren’t having problems utilizing your product and services, let alone approaching the point where they downgrade their subscription.

If profits churn does happen, it’s possible that your customer may be on the brink of leaving– and your operations or services team should rapidly do something about it to prevent this from taking place.

How to Calculate Profits Churn Rate

You should calculate revenue churn rate in month-to-month intervals. Start with subtracting the regular monthly repeating income (MRR) at the end of the month from the MRR you had at the beginning of the month.

Then, subtract any income you accrued from upselling or cross-selling to existing customers. Finally, divide this number by the MRR you had at the beginning of the month.

You may, in fact, end up with a negative percentage, which would indicate your income gains from existing clients surpassed any losses. However keep in mind, revenue from new consumers ought to not be included in this estimation.

Profits Churn Rate Formula

Monthly Earnings Churn Rate = [( MRR at Start of Month – MRR at End of Month) – MRR in Upgrades during Month]/ MRR at Start of Month

Example of Earnings Churn Rate

To demonstrate revenue churn rate, let’s use a similar example to the one we utilized above.

For this example, let’s state that our company began September with an MRR of $50K. Because month, we lost $5K to churn and gained $2.5 K from upgrades. For this month, our profits churn rate would be 5 percent. ([ ($ 50,000 – $45,000) – $2,500]/ $50,000 = 5%).

For October, considering that we’ve gotten $2.5 K in upgrades in addition to $10K in new MRR our starting MRR is going to be $57,500. If we lose $7K to churn and get $3K to upgrades, our churn rate would be 6.95% ([ ($ 57,500 – $50,500) – $3,000]/ $57,500 = 6.95%).

3. Existing Customer Income Development Rate

Procedures: the rate your service is generating revenue from customer success.

Existing customer profits development rate is really essential for your service.

A climbing up rate would suggest that your marketing, sales, and account teams are doing a great task at encouraging consumers to increase costs. It also suggests that your customers are quickly recognizing the worth from your engagement. On the other hand, a going to pieces or falling development rate should put your success team on alert.

A stagnant existing customer revenue growth rate might likewise threaten for your company. After all, obtaining a new customer is really four times more expensive than upselling to a present one, consequently hindering your company’s ability to scale.

If your existing customer accounts aren’t growing, you’re most likely not investing enough time and budget plan on customer retention and stopping working to take advantage of easily tapped sources of profits.

How to Determine Existing Customer Income Development Rate

Once again, the formula listed below needs to only take into account profits created from existing clients. No new sales are associated with this measurement. Existing customer profits development rate can be applied to a single account taken a look at over a long period, or it can be determined to show the “big picture.”

Customer Profits Growth Rate Formula

Month-to-month Revenue Development Rate = (MRR at the End of Month – MRR at the Start of Month)/ MRR at the Start of Month

Example of Existing Customer Earnings Development Rate

For simplicity’s sake, let’s use the same example as the one above.

If we begin September with an MRR of $50K then lose $5K to churn, our existing profits development rate is -10% (($ 45,000 – $50,000)/ $50,000 = -10%). For October, if we start at $57.5 K and lose $7K, our existing profits growth rate is -12.2% (($ 50,500 – $57,500)/ $57,500 = -12.2%). Also visit Push Notification Services to grow your business.

4. Repeat Purchase Ratio

Procedures: the rate clients come back for another purchase.

In simple terms, the repeat purchase ratio (RPR) is the portion of customers that have returned to buy from your company once again. This metric is a great indication of customer loyalty– frequently utilized by marketing and sales teams to evaluate the performance and effect of the business’s customer retention technique. Although this particular metric typically applies to products, you can also use the exact same formula to duplicate membership or contract renewals.

What’s specifically helpful about repeat purchase ratios is their application to particular demographics. By having a look at which types of consumers or companies are making one of the most repeat purchases, you can adjust your target buyer personas appropriately and notify marketing about where their efforts ought to be increased or focused.

How to Compute Repeat Purchase Ratio

This is a measurement that can be computed in any timeframe– weekly, monthly, quarterly– and your customer success group will still find the data important.

In a B2B context, for instance, you may sell a widget that’s utilized in the production process of a number of different customers who offer a number of different products. Each customer’s need for your product may differ based on its own sales cycle, producing treatments, etc. One brand-new customer may make one big purchase order from you at the start of the year, while another may make purchases monthly.

In this sense, the RPR ought to be taken with a small grain of salt. If your customer success team is really on its A-game, they’ll likewise benchmark acquiring frequency for each individual customer in addition to the overall repeat purchase rate.

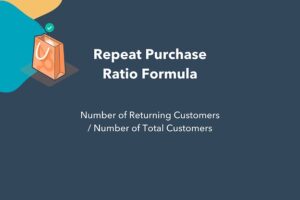

Repeat Purchase Ratio Formula

Repeat Purchase Ratio = Variety Of Returning Customers/ Number of Total Clients

Example of Repeat Purchase Ratio

Let’s say we start the month with 5K consumers registering for our service or product. At the end of the month, only 4K of those customers go back to our service. In this case, our repeat purchase ratio would be 80% (4,000 clients/ 5,000 clients = 80%).

5. Item Return Rate

Procedures: the rate items are returned.

Another metric that applies particularly to companies that offer tangible items (as opposed to services or subscriptions), is your product return rate. This is the proportion of your overall systems sold that have been sent back to you.

Although items could be returned for myriad factors, item returns are never ever great, and the ultimate objective is to keep this number as close to no as possible.

While the B2C retailer average return rates for in-store and online purchases hover around 9% and 20% respectively, product returns in a B2B setting can be a bit more deadly. Given both the larger sales volume and extended duration of the typical B2B sales cycle, product returns can be extremely troublesome for your customer retention strategy. Customer care groups must rapidly make amends prior to the sale (and/or customer) is lost entirely.

Item return rate is most certainly an information point that customer success teams must pay close attention to. Not just can customer success supervisors use it to validate connecting to internal celebrations and jumpstarting the troubleshooting procedure, but they can also utilize the info to let the right people know where the item or its delivery needs to be enhanced.

How to Calculate Item Return Rate

The timeframe for your product return rate will also depend upon your sales volume. What’s effective for another business might not work for yours. But here’s the base formula and it is necessary that whatever period you select to contextualize the computation, you regularly comply with it.

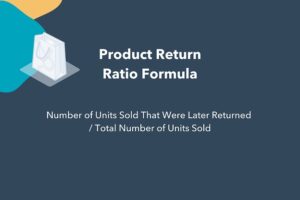

Item Return Rate Formula

Product Return Rate = Variety Of Units Offered That Were Later On Returned/ Total Number of Units Sold

Example of Product Return Rate

For this example, let’s state we’re a sporting items business selling baseball cleats. In September, our most popular item sold 10K units, however 7K were returned later that month. Our item return rate would be 70%, which may show a substantial problem with that shoe (7,000 units returned/ 10,000 systems = 70%).

6. Days Sales Outstanding

Procedures: days taken to gather payment from a sale.

In a nutshell, days sales outstanding (DSO) can be referred to as the average variety of days that receivables (customer charges, costs, payments) stay outstanding prior to they’re gathered. DSO not only demonstrates how well your company’s accounts receivables are being managed, however also how devoted a customer is to preserving a healthy working relationship with your company.

The longer the DSO, the longer it’s taking customers to pay their expenses– which might be a bad omen for your customer retention technique. It is essential to take a look at DSO as a whole to determine trending habits and what you can do to fight DSO figures on the increase.

But on a specific basis, a prolonged DSO might suggest your customer is dissatisfied with your business’s services or product, or that your marketing and sales groups are supporting and closing customers with credit or cash flow problems. Remember, reliable customer success methods start prior to the acquisition phase.

How to Determine Days Sales Exceptional

DSO is usually applied to the whole set of billings that a business has outstanding at any offered time, rather than to a single invoice. You can identify your DSO on a monthly, quarterly, or annual basis by dividing the variety of balance dues throughout the chosen time period by the overall worth of credit sales during the very same period. Then, increasing the result by the number of days in that timeframe.

The final figure is equated with the typical variety of days it takes your company to gather on a billing. But for simplicity’s sake, we’ll utilize a yearly DSO formula, which can be found listed below.

Days Sales Outstanding Formula

Yearly Days Sales Exceptional = (Accounts Receivable/ Yearly Profits) × 365 Days

Example of Days Sales Outstanding

Let’s state our theoretical company made $100K in sales this year. Of that $100K, $75K has actually been collected. In this case, our yearly DSO would be 274 days (($ 75,000/ $100,000) x 365 days = 274 days) and our monthly DSO would be 23 days (($ 75,000/ $100,000) x 31 days = 23 days). That could be low or high depending upon the industry you’re working in.

7. Net Promoter Score ® (NPS).

Steps: customer complete satisfaction and how likely clients are to refer your business to others.

Net Promoter Rating quantitatively measures basic satisfaction and loyalty to your brand. When you have actually calculated your overall Net Promoter Score, it will tell you if your customers are content and going to refer your products or services to others.

What’s more, if you compare your Net Promoter Rating to your revenue development rate and customer churn rate, you may be able to forecast possible development through customer retention and referrals.

While a high NPS does not ensure development and retention, determining and incentivizing brand evangelists can help drive referral service. This can work exceptionally well along with content marketing efforts such as the development of case studies, website testimonials, and other forms of social evidence.

Alternatively, a poor or middling rating provides the chance to deal with a fulfillment issue prior to it’s too late.

How to Determine Net Promoter Score.

As basic as it may sound, this score is determined by asking your customer one concern: “How likely are you to recommend our company to a buddy or colleague?”.

That’s it! The customer is then triggered to choose a score in between 0 and 10. Note that just 9’s and 10’s are promoters, and any customer providing a ranking of 6 or below is thought about to be a detractor.

If you feel it would be helpful, you can ask a follow-up question in your NPS study (something along the lines of “Will you share why?”)– however keep in mind that reaction rates decrease as the variety of concerns asked increases.

Then, you can calculate Net Promoter Score by deducting the portion of critic reactions from the portion of promoter responses.

Net Promoter Rating Formula.

Net Promoter Rating = % of Promoters – % of Detractors.

Example of Net Promoter Rating.

A wise company would distribute an NPS survey after a customer service case is dealt with. If after a month, we observed 50 promoters, 25 neutral scores, and 10 critics, our total NPS would be 47 (50/85 = 59%, 10/85= 12%, 59% – 12% = 47).

8. Time Between Purchases.

Procedures: The average time consumers take to buy from you once again.

Time between purchases determines the time it takes for an average customer to buy from you once again. This is an essential retention metric because it shows you how happy consumers are with your product or service and how willing they are to try rivals in your market.

How to Compute Time In Between Purchases.

To calculate the typical time between purchases, you’ll need to monitor the purchase dates for all consumers. A CRM can assist you do this, as it can establish contact residential or commercial properties that tape-record whenever clients make repeat purchases.

As soon as you have a recording system, you’ll require to combine every customer’s typical purchase rate. For instance, if a customer buys from you today, then buys another product a week from now, their purchase rate would be seven days. If they bought from you again two weeks later on, then their average purchase rate would be 10.5 days.

After discovering the sum of all private purchase rates, divide that number by your overall.

repeat clients. Be sure to omit any new consumers, as this metric must just determine your existing ones who made repeat purchases.

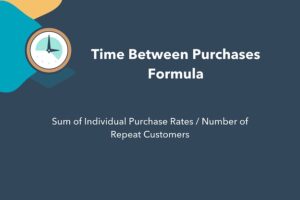

Time Between Purchases Formula.

Time Between Purchases = Amount of Individual Purchase Rates/ Number of Repeat Clients.

Example of Time Between Purchases.

For this example, it’ll be much easier to explain computations utilizing the Excel sheet below.

In September, our small company just had 5 repeat customers. By computing the typical purchase rate for each specific customer, we can see for how long it considered each one to purchase from us once again. Balancing these numbers together leaves us with an average time between purchases being 8 days (40 days/ 5 customers = 8 days).

9. Loyal Customer Rate.

Procedures: the number of consumers to repeat purchase over a duration.

Devoted customer rate merely refers to the number of customers who have actually made a repeat purchase with you within a given time variety. Considering that your most loyal clients buy from you the most, this metric recognizes the percentage of your customer base that’s demonstrated loyalty to your company.

It is very important to know how many devoted consumers you have because these people are the most important members of your customer base. That’s since they not just drive the most sales, but they’re also the most likely to share positive word-of-mouth about your organization. By knowing who these faithful customers are, you can take advantage of chances to collect reviews and motivate customer advocacy.

How to Determine Devoted Customer Rate.

Loyal customer rate is determined by very first recognizing the overall variety of clients that your company had actually during an offered month, quarter, or year. This consists of both existing customers and brand-new ones.

Then, you need to find both the variety of existing clients who made an extra purchase and the number of brand-new consumers who made multiple purchases. Add those values together to get your overall number of devoted clients.

Lastly, divide your total number of devoted customers by your overall clients to get your loyal customer rate.

Loyal Customer Rate Formula.

Faithful Customer Rate = Number of Repeat Consumers/ Total Consumers.

Example of Faithful Customer Rate.

In this example, let’s state we had 20K overall consumers throughout September. Of that 20K, 2K were existing clients who made additional purchases and 3K were new consumers who made multiple purchases. By averaging these worths together, we would find that our devoted customer rate comes out as 25% (( 2K consumers + 3K clients)/ 20K consumers = 25%).

10. Customer Lifetime Worth.

Measures: the earnings generated by a single customer.

Customer lifetime worth (CLV) determines how much income is generated by a single customer. Whether you sell private service or products, or you sell software application billed every year, this is a metric to track consistently. Preferably, you ‘d see CLV increase or stay consistent, as a shrinking CLV recommends you’re either recording low-value clients or losing customers faster than you had in the past. Also check Hyvee connect login to access hyvee easily.

How to Compute Lifetime Worth.

First, figure out the average income quantity you can anticipate from a customer over a year. You determine this number by dividing your gross annual sales by the overall number of special clients in that year.

Then, you’ll want to figure out for how long a customer sticks with your organization in regards to years.

From there, you’ll multiply the average profits per customer by the typical life-span of the customer to produce your customer lifetime value.

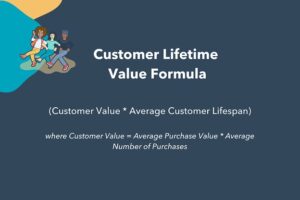

Customer Life Time Worth Solution.

Customer Lifetime Worth = Customer Worth * Typical Customer Life Expectancy.

where Customer Value = Average Purchase Value * Average Variety Of Purchases.

Example of Customer Life Time Value.

A SaaS company expenses consumers each year for software application. The company took in $5 million in profits last year and has 2,000 clients. Dividing its income of $5 million by its existing customer base of 2,000 produces an average profits of $2,500 per customer per year.

The company evaluated its customer durability and found the average quantity of time a customer does business with the software application company is three and a half years.

Increasing the typical profits of $2,500 by the typical life expectancy of four and a half years yields a customer lifetime worth of $11,250.