This article will show Mint Alternatives sites apps. Understanding your credit score is extremely beneficial if you are attempting to plan for your financial future. Mint Alternatives is one of the very best and most widely known credit reporting websites/apps.

Top 17 Mint Alternatives In 2023

In this article, you can know about Mint Alternatives sites apps here are the details below;

It provides users free access to their credit rating and credit report, in addition to assisting people in comparing financial products that they might receive, such as loans or charge cards aimed at their credit level.

Consider a few of the following options if you’re trying to find an Mint Alternatives sites apps. We have investigated and curated some great alternative websites and apps similar to Mint Alternatives for credit reporting (and much more) in the list below.

Mint Alternatives sites apps is a terrific starting point for keeping an eye on the health of your finances. However, it has some constraints regarding the credit reference firms that it deals with and the features it offers.

1) Credit.

Credit.com is an app and browsers-based credit rating tool that reports your Experian credit history. The app is free of charge, without any credit card needed to open an account.

There is an Android and Google Play variation of the app, and you can access the info using your web browser also if you prefer.

In addition to informing you of your scores, Credit will likewise describe how scores are calculated and provide users advice on enhancing their scores.

The tool is useful for credit education and repair work, and considering that you can establish notifies, it assists in the battle against identity theft.

2) Annual Credit Report.

While most of the services and products in this list offer endless reports from one specific company, the Yearly Credit Report works a little differently.

This service provides users a free report from the three main credit reference agencies: Experian, TransUnion, and Equifax, as soon as each year. Also check Get out of payday loans

This is useful for people who will be checking out the market for a considerable purchase such as a mortgage, because it helps prospective debtors make certain that their monetary details are accurate throughout all the major credit reporting groups.

3) Credit Sesame.

Credit Sesame expenses itself as an individual credit management service that improves their credit score and general finances.

It utilizes TransUnion to supply a straightforward and easy to understand summary of the elements that affect a person’s credit rating.

It also uses a service that helps people choose cards or loans appropriate for their financial resources. This can be beneficial for individuals with a good credit rating, allowing them to recognize the best deals on the marketplace.

It is likewise useful for those in developing their credit rating since it will help them pick the financial products that offer the very best rates and the best chances of being accepted with their existing rating.

4) Experian.

Experian CreditWorks Premium is an aid-for tool that checks Experian, TransUnion, and Equifax credit reports daily, and after that, it notifies users if they have changed.

The credit score is based on FICO Rating 8 for most of the calculations, but for some kinds of Credit, other ratings may be utilized.

This tool is a good option for peoples who want to optimize their credit rating, prepare a house purchase quickly, and stressed over identity theft. There is a regular monthly charge, but the very first month has a low introductory rate, allowing users to try the service for minimal risk.

5) Equifax.

Suppose you simply desire a bare-bones report and do not wish to provide your individual information to a middleman to get them. In that case, you have the alternative of going straight to the credit referral companies themselves.

Equifax permits users to request six free credit reports per year. This is a bare-bones service. There are no loan or charge card matching tools and no notifies.

The benefit, however, is that you are going direct to the source. This indicates less risk of spam or marketing calls from the developers of the apps and individuals trying to offer loans.

6) CreditWise.

CreditWise is a complimentary credit monitoring app that is produced by Capital One. While a lending institution makes the app, it does not affect your credit report to establish an account with it.

The service has some rather useful tools, such as a simulator, which enables you to see what is likely to happen if you make sure changes to your monetary routines, such as settling a loan or increasing the limit on one of your credit cards.

This is a useful kind of financial education that can help you prepare yourself to make significant loan applications in the coming months or years.

7) TransUnion.

TransUnion allows users to ask for one credit report annually, free of charge. Everyone who does’t use a credit reporting tool ought to consider taking advantage of this.

If you desire more than one report per year from TransUnion, then you can register for their year-round service, which allows you to access your credit report as frequently as you wish.

This service also informs you if new accounts opened in your name, changes to your charges card balance, or any unfavorable reports made by financial institutions.

8) Bankrate— Quizzle.

Bankrate– Quizzle is a credit report tool produced when Quizzle was obtained by the Bankrate group. Also check online legal services

This credit improvement tools offers credit reports, charts, and a breakdown of the elements influencing your credit report.

Registering for an account is free. The tool uses access to your full credit report with weekly updates on your rating, signals when your credit report modifications, and tracking tools to assist you in understanding how your credit history is altering with time. The tool also offers individualized rates for monetary products.

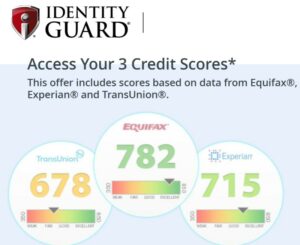

9) Identity Guard.

IdentityGuard is a tool that assists in protecting users from identity theft. It is easy to set up account, and when you are up and running, you can get signals about major changes to your credit record, giving you an early warning in the event of prospective fraud.

One especially nice thing about the service is that it has tiered pricing, with the option of signing up for a family account and securing not simply your monetary details, however that of your spouse and kids also.

Charge account opened with a childs SSN are a typical fraud nowadays and something that numerous young adults only find out about when they begin their own financial life.

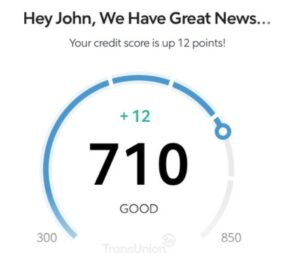

10) Discover Card FICO Rating.

This tool from Discover offers users a FICO rating based upon info from TransUnion. FICO scores are the most frequently utilized scores by the major lending institutions.

The score is based on the quantity of cash owed, the length of the individual’s credit history, just how much brand-new Credit has recently been opened, and the type of that Credit.

Discover provides users with a regularly updated rating. The date that the ball game was updated being suggested on the control panel.

The score are pictures and might not be upgraded as frequently as some other tools, but it is free to access and a great option for people looking to learn what info TransUnion has on their records.

11) WalletHub.

WalletHub offers a free credit history updated daily, along with totally free credit reports and an analysis of the elements that go into creating your credit score.

The tool is accessible through a sites and also a mobile app. Signing up is quick and easy way, and the service will assist you in discovering charge cards, rewards cards, loans, and home mortgages that might be suitable for you based on your current credit score.

Most free credit score tools use only weekly or regular monthly updates, so having access to an everyday update makes this an attractive choice.

12) PrivacyGuard.

PrivacyGuard is a premium identity theft protection tools that consists of credit reporting, score tracking, and credit education services.

There is an affordable initial offer for the service, permitting individuals to check it out without investing a lot of money.

Users get access to their are VantageScore and can ask for signals for major modifications such as unfavorable marks on their account, considerable balance modifications, or new accounts being opened in their name.

There is also the alternative of day-to-day credit monitoring that tracks all 3 of the significant credit recommendation firms.

13) Chase Credit Journey.

Chase Credit Journey is a complimentary credit report reporting app that is open to anyone who wants to examine their score, even if they are not a Chase consumer.

The application updates weekly and users can check their rating as typically as they want without needing to worry about the check adversely impacting their rating.

The tool likewise provides a free score simulator that assists individuals in understanding how altering their monetary behavior might affect their scores in the future. Users may likewise be given deals for loans or credit cards that match their financial resources.

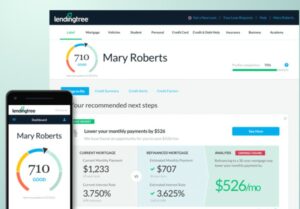

14) LendingTree.

LendingTree uses a credit report service that provides users with an easy to understand report of their credit history in-app or website kind.

The service uses VantageScore 3, which is a score developed from merging the credit rating reported by Equifax, TransUnion, and Experian.

This score is not a ball game that many loan providers use, however it is a very good estimate, and it is good enough to help users choose whether they are on the best track with their existing monetary practices. LendingTree’s easy to use the app and simple signup procedure makes it appealing to many people.

15) Rocket HQ.

Rocket HQ is a complementary tool that uses users’ access to their TransUnion credit report and enables them to track their VantageScore.

The tool offers a variety of monetary education tools to help people comprehend how their Credit and individual financial resources work, and likewise offers answers to typical questions about things like home loans and loans.

Rocket HQ is free to utilize, and examining your credit score with the service will not leave any considerable marks on your credit report, so you can monitor your rating as often as you wish. Also check Loan Management Software

16) myFICO.

The myFICO app and website are run by FICO themselves and have actually tiered rates based upon the features that the user desires.

The least pricey tier to uses regular monthly updates on Experian credit files, while the other tiers offer 3-bureau monitoring at numerous periods.

All tiers provide identity theft insurance. The FICO score is the score that 90% of lenders use, so it is the most beneficial score for people to have if they are thinking about securing a substantial loan in the future.

The tool costs more than the majority of other services, but for some people, especially those with households who are working towards a mortgage, the insurance coverage offering might make it rewarding.

17) NerdWallet Free Credit Report.

Like lots of other tools, NerdWallet uses VantageScore 3.0 to permit users to track their credit reports.

This service is provided in-app kind for Android and iOS users, along with via their website. Users can view their rating, monitor their rating for modifications thanks to weekly updates, use the simulator tool to get a concept of whether altering their credit limits or paying for specific debts would be a good idea for their scores, and work to enhance their credit rating with mindful management thanks to the details provided.